Lazada and Shopee Seller Summits in July

After the excitement of Shopee Seller Summit, July brings us Lazada Seller Summit. Lazada is rolling out a new wallet feature called LazCash, a virtual cash back which offer customers extra discounts for their purchases. Their CEO proudly shared that Lazada’s overall growth has jumped by 45%, also boosting their new venture CHOICE which is a microsite that pushes for product with lower price. This year’s their tagline, “Always the Better Price,” aims to attract even more buyers.

Shopee’s New Directions

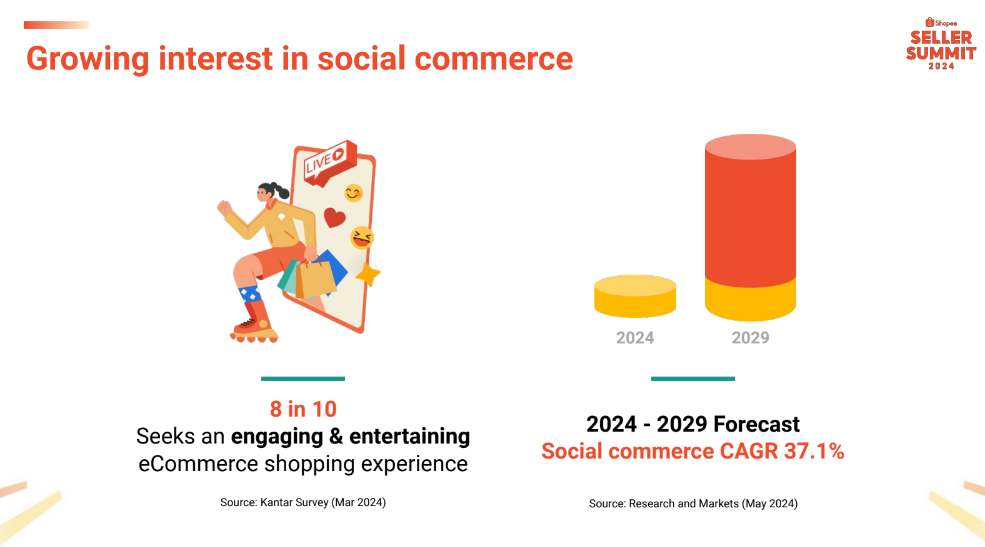

Shopee Singapore also had its seller summit this month, this year summit they are betting big on social commerce as they acknowledge a projected growth rate of 37% over the next five years which it’s clear why Shopee is pouring resources into Shopee Video and Shopee Live.

Shopee Malaysia’s Revenue Dip

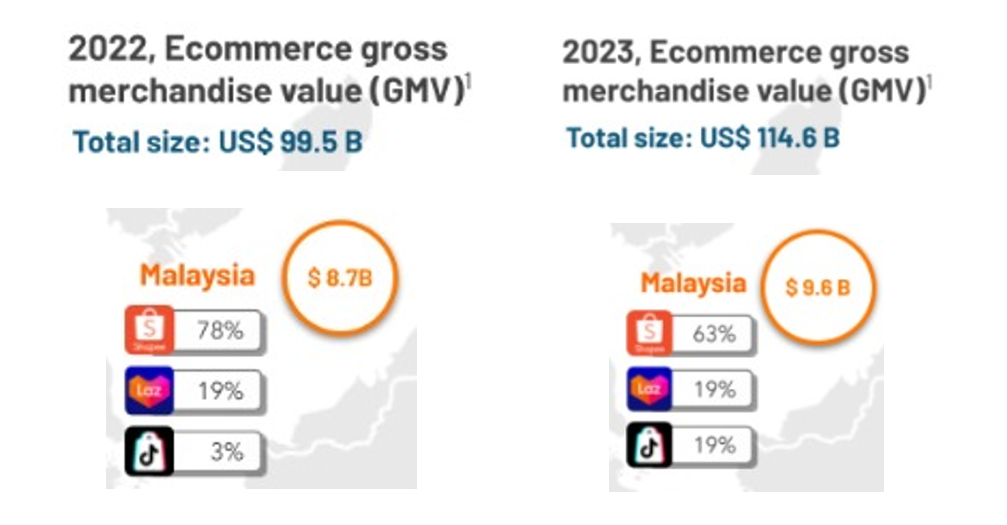

As expected, Shopee Malaysia Revenue dropped, but I was surprised that Malaysia Direct SG impact was that huge to create such a steep drop. Closing at Rm1.7B, we can see many local seller must have suffered during that transition.

TikTok’s Steady Climb

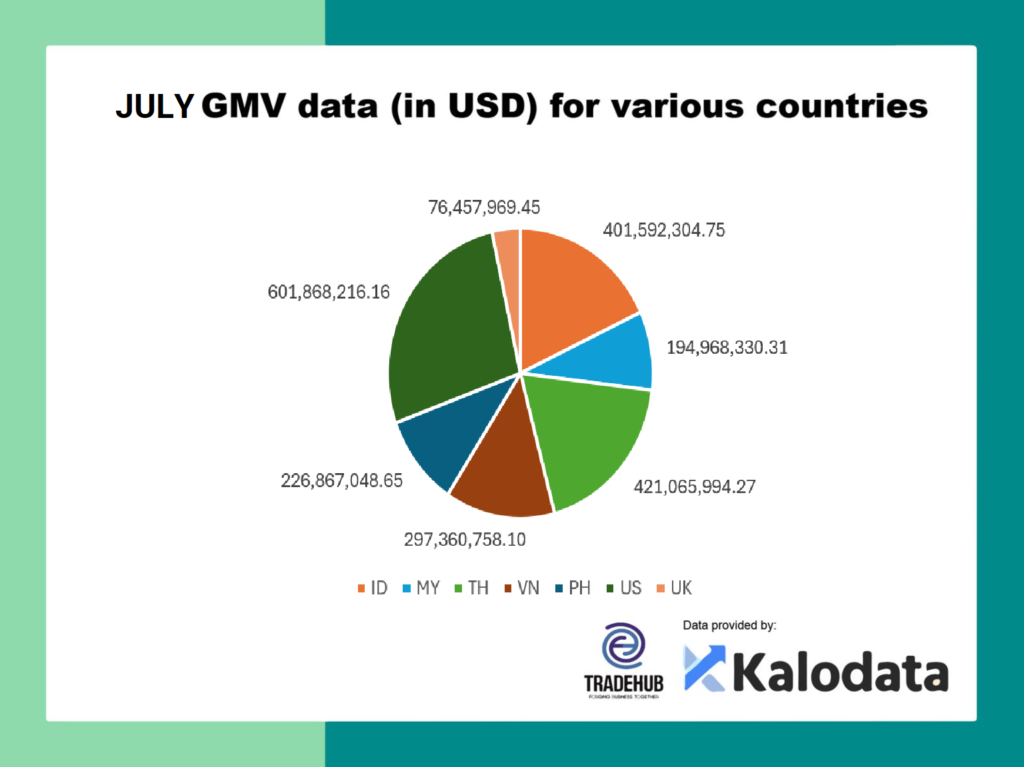

On the other hand, TikTok’s revenue slightly climbed to RM860 million. Although they’re still short of the RM1 billion mark, they’re on track to reach it by the end of the year. TikTok hasn’t been as active in increasing their fee compared to the other marketplace’s, probably they see this as an opportunity and are leveraging the commission fee gap to draw more sellers.

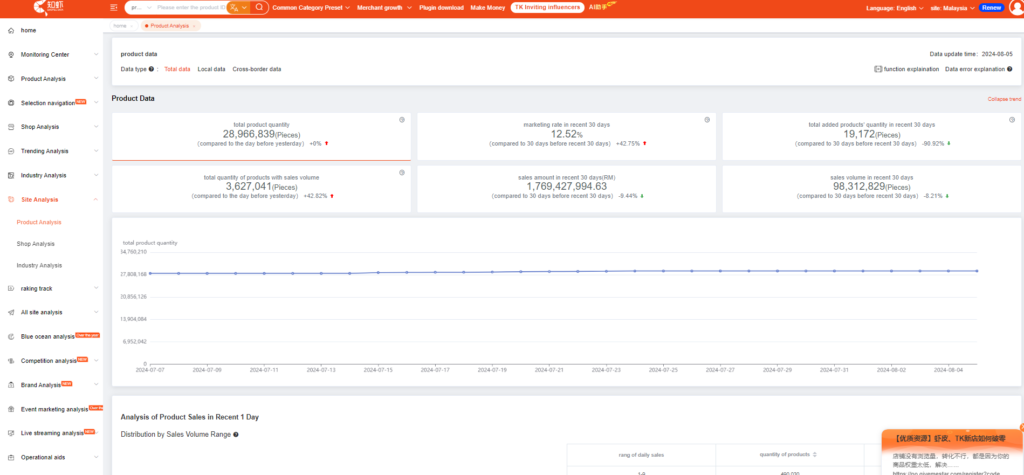

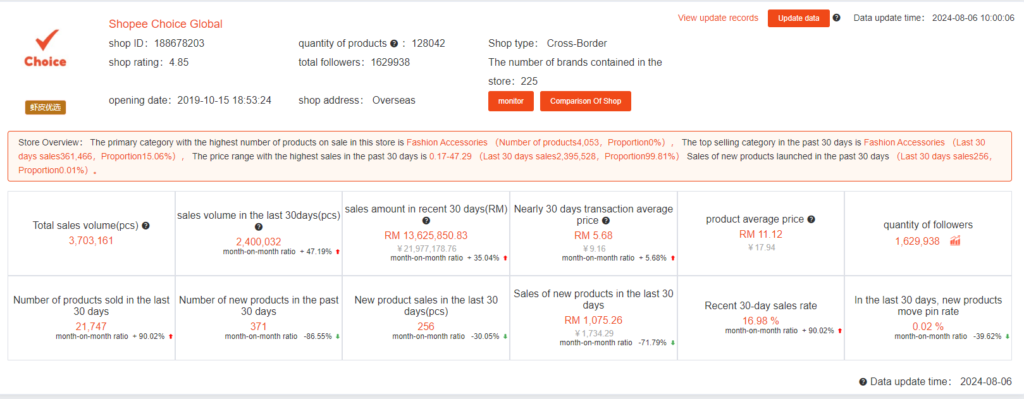

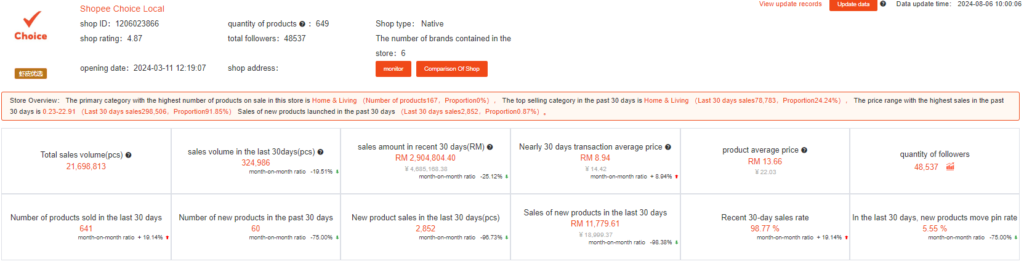

Shopee Choice and Market Traffic

Although Shopee face an overall drop in GMV, but their other division Shopee Choice has grown impressively, with both global and local sales increasing by almost 40%, hitting RM13 million and RM2.8 million, respectively. This growth in another view can be seen as creating tough competition for local sellers.

However to be 100% certain that Shopee revenue drop mainly comes from MY direct Sg is not attainable yet as we couldn’t estimate Lazada monthly GMV because we haven’t partnered with a data miner for Lazada yet. But it’s interesting to see that Lazada still holds a strong 19% market share, even as TikTok eats into Shopee’s share.

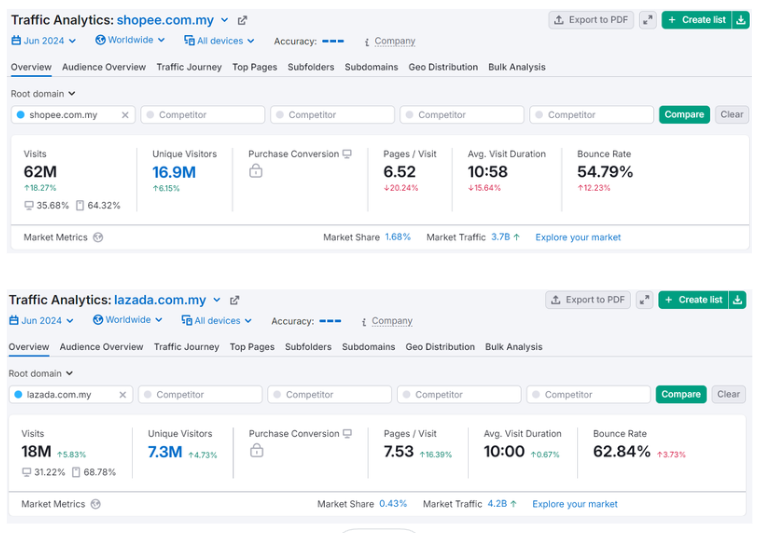

In view of that, we will start to track their monthly website visitor too. Shopee has a monthly unique website traffic of 16.9 million, while Lazada pulls in 7.3 million. This is why although I’m not into Lazada, but I will still maintain my store there as they still pull a substantial traffic.

Last but not least, although things are getting tougher for seller, the ecommerce winter season is coming to a close soon, hopefully everyone is ready for the year end sales which will start from 9.9.

This report is powered by robust data analytics from two industry leaders: Mobduos for Shopee and Kalodata for TikTok. But before we dive into the exciting findings, a word of caution: while our data provides valuable insights, always remember that there may be slight variations from real-time statistics. Get a free trial to Shopee and Tiktok Bigdata and let us know if you would like a promo code to purchase when you find them essential .