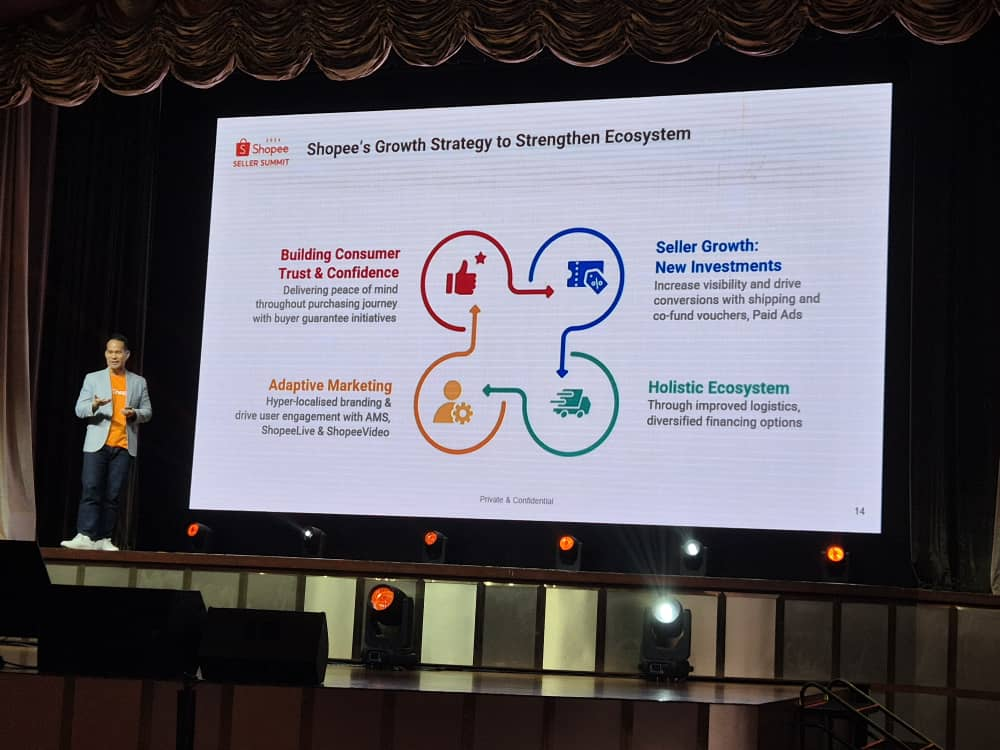

Just in the blink of an eye, we are now in the second half of the year. Let’s start by sharing some of the best insights from Shopee Seller Summit 2024. It’s no surprise that Shopee still leads the Malaysian e-commerce space as they are often the first movers in the market.

As a marketplace, Shopee excels at maintaining a balanced ecosystem for both buyers and sellers. For buyers, they introduced the ‘Change of Mind‘ policy, which increases buyer confidence in online shopping. For sellers, they improved how AMS works and provided more sales channels such as Malaysia Direct SG Program.

Shopee Tops the Growth Again

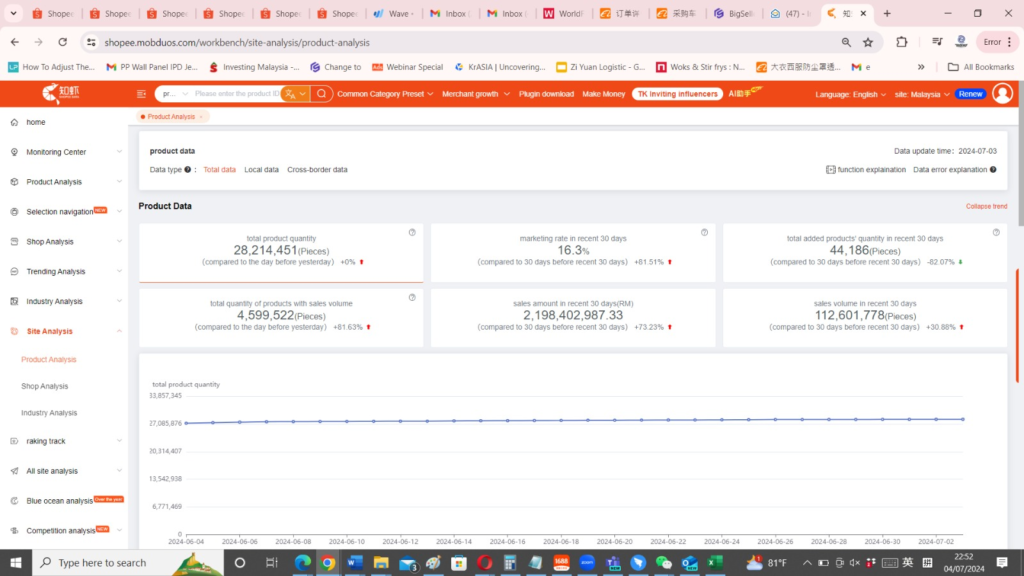

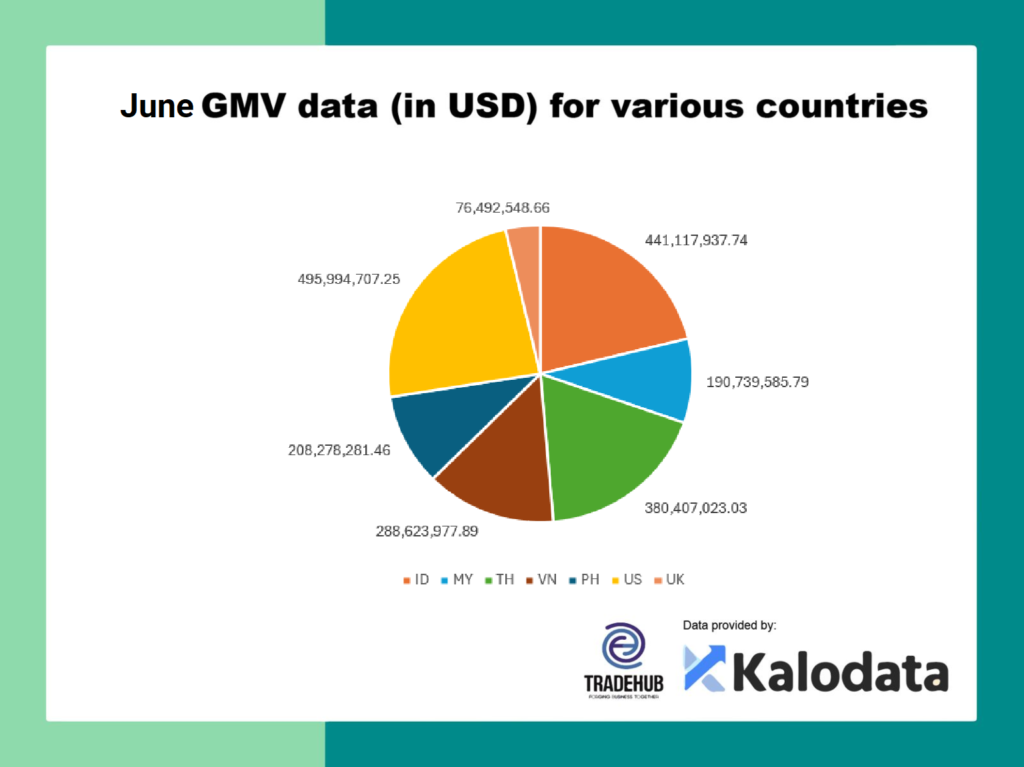

With initiatives like Shopee Choice and Malaysia Direct SG, it’s no surprise that Shopee GMV boosted to RM2.1 billion. However, this growth comes at a cost for many sellers who don’t understand the differences between Singapore and Malaysian markets as in Singapore, sellers are the one that pay for most part of the shipping fee. Hence it may also be the wrongly priced goods that help spike sales, for example, a product launched at $6.50 rose to $25.87 within two weeks due to such misunderstandings. Therefore, I predict that July GMV will likely stabilize or drop.

TikTok Trying to Maintain Its Ground

I had anticipated that TikTok would maintain its GMV at RM1 billion, but they have yet to surpass this milestone, perhaps due to the competitive landscape. While TikTok can sell in volume, their price points are lower than Shopee’s. This demonstrates that offering the lowest price can attract traffic but doesn’t necessarily boost revenue. Lazada tried a similar strategy last year with their all below RM9.90 campaign, which failed despite heavy subsidies.

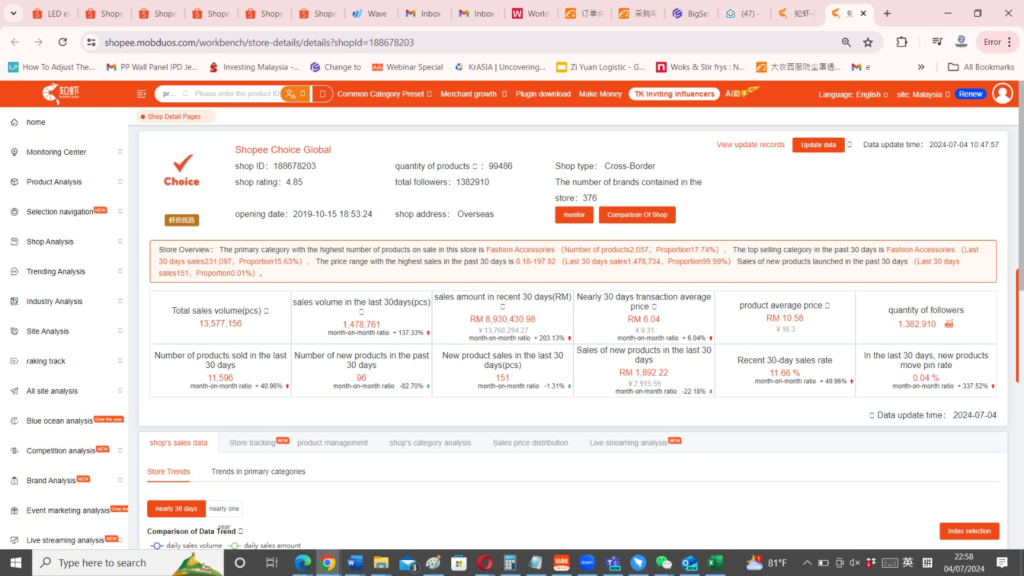

Shopee Choice & Lazada Choice

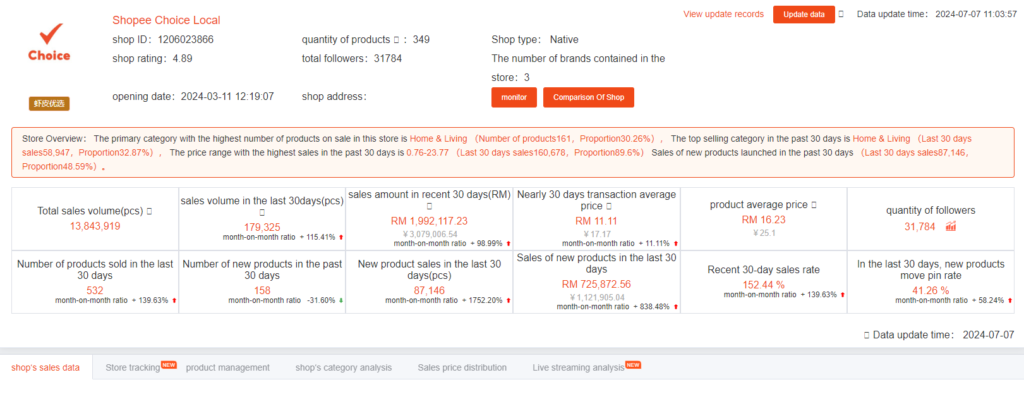

Although saying that, Shopee did not just sit things through for lower price, they indeed have launched Shopee Choice where they help China factory to sell direct to Malaysia, you will notice their price point is very attractive. We will be keeping them in track to monitor their sales trend too moving forward. For this month Shopee choice is at RM 8.9m, while Shopee choice local is at RM2m.

Ending the Note with Something interesting about Lazada

With the changes and update in Lazada for the past few month, it really make’s me wonder how come they suddenly wake up and listen to sellers voice.

With the recent announcement it finally make sense. Kaya Qin and Zed Li who both have track records of working along with seller and brands at the past. With both of them helming the CEO and COO position, they might really stand a chance to tilt the ecommerce marketplace back to balance.

Cant wait to see them both at possibly Malaysia most impactful ecommerce seller summit for 2024 and see what have they in play for sellers and brand for FY24/25. Get your tickets here.