As November rolls in, the most awaited and dynamic month for e-commerce sellers is finally here! How was your 11.11 experience? I hope everyone managed to at least match last year’s results—or, even better, exceeded them! On our side, sales have been steady with results comparable to last year, though we didn’t see much growth this time around.

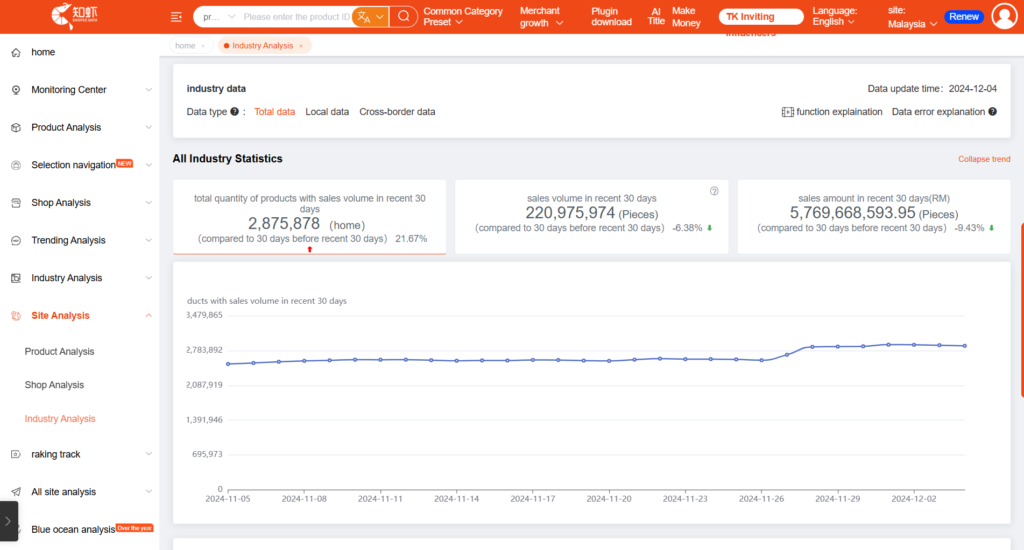

Insights from TaoBao E-Commerce Scene

As the most sought after 11.11 Global Shopping Festival, there’s a noticeable shift towards high-end and experiential products. The industry’s growth has been heavily supported by billion-dollar government subsidies and significant platform discounts, showcasing how strategic investments can propel the market forward.

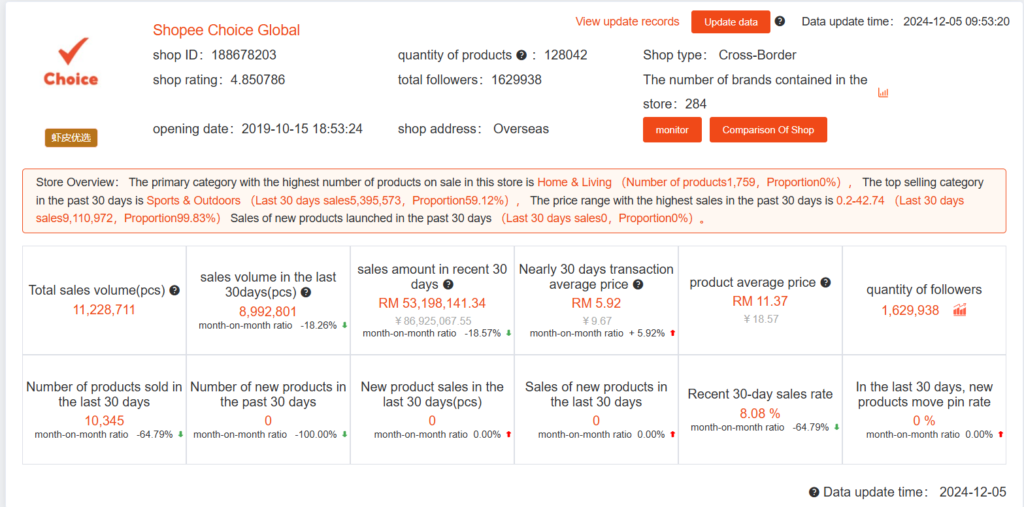

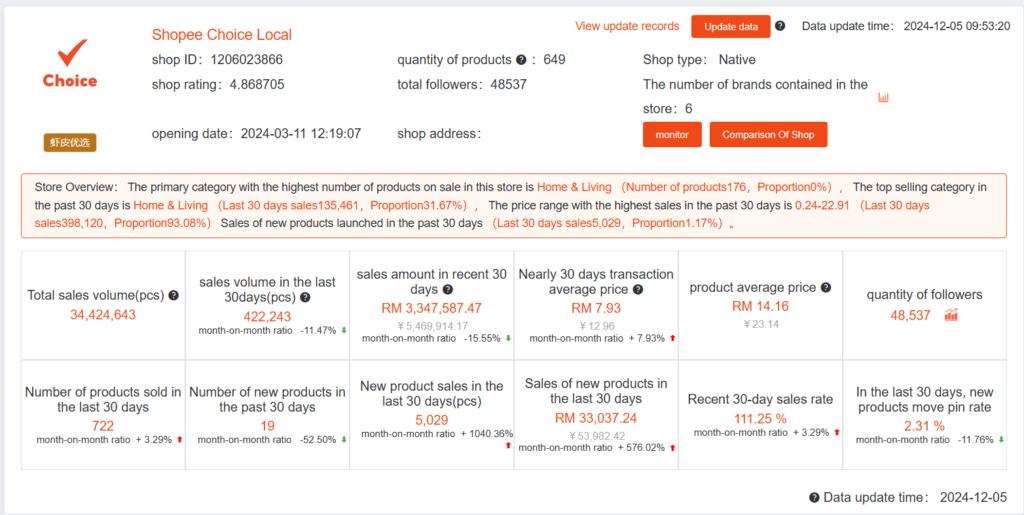

Shopee Updates

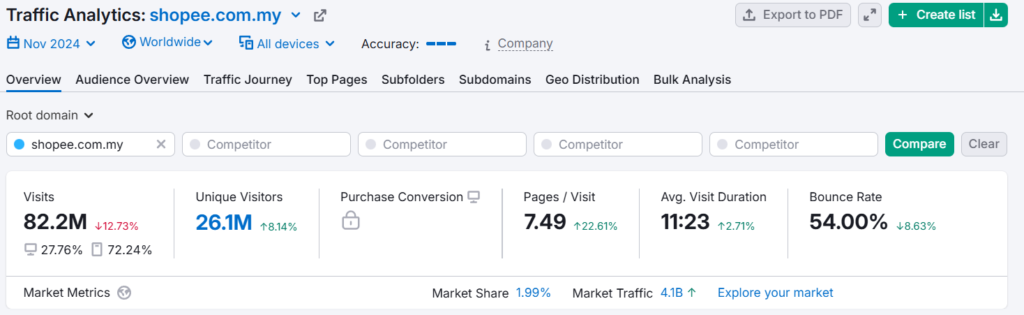

Shopee has raised the bar for Mall and Preferred Sellers, requiring a 90% Fulfillment Rate (FHR). While this heightened standard might seem challenging, it’s understandable as Shopee aims to enhance the buyer experience by ensuring faster delivery times. Despite these changes, Shopee remains the leading e-commerce marketplace in Malaysia.

However, sales performance for 11.11 on Shopee didn’t show significant growth, which was a bit disappointing. Interestingly, both Shopee’s local and global “Choice” segments experienced a dip in sales compared to the previous month. This might indicate a shift in buyer behavior, with consumers becoming more discerning and realizing that cheap prices don’t always equate to good value.

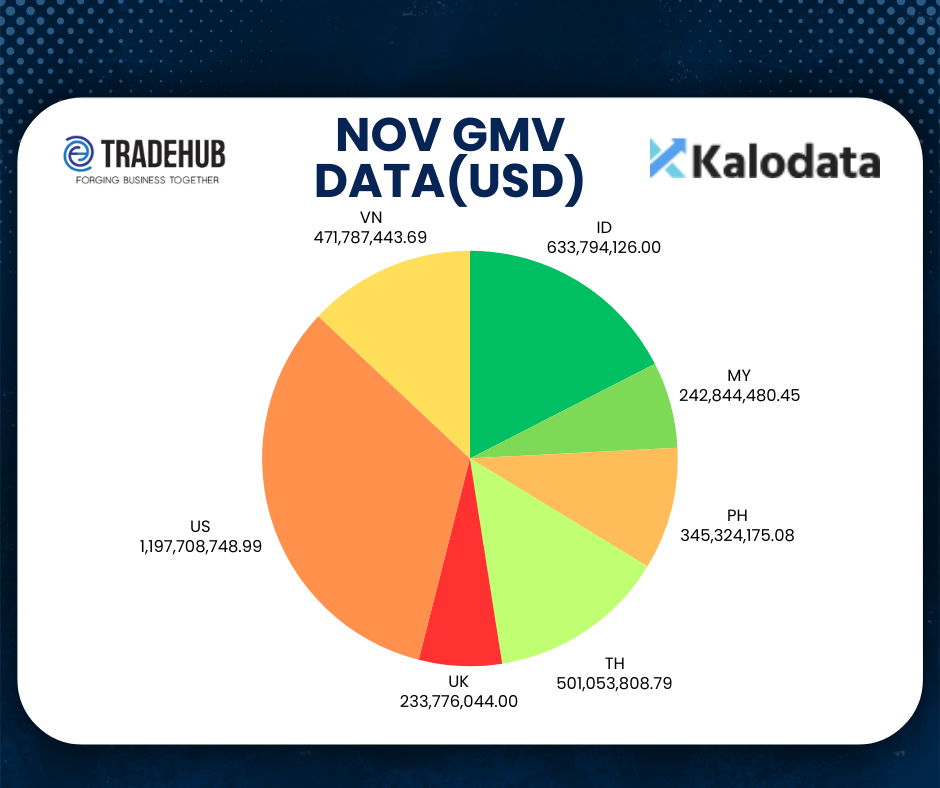

TikTok’s Surprising Performance

TikTok saw a surprising drop in performance this 11.11 compared to its October report. It seems the platform didn’t focus as heavily on this event, recognizing that it’s primarily impactful for marketplaces rather than social commerce. Despite this, TikTok still managed to hit the impressive $1 billion mark, which is commendable.

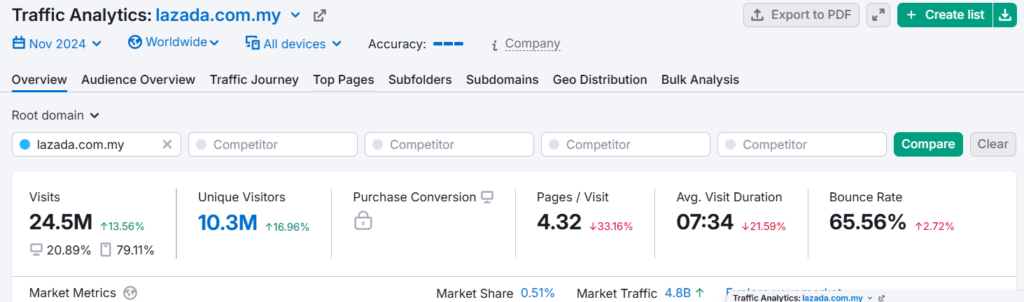

Lazada’s Remarkable Traffic Growth

Lazada’s strategy for 11.11 paid off, as they successfully attracted a surge in website traffic. For the first time, their traffic is no longer just a quarter of Shopee’s—a testament to the hard work of the Lazada team. Beside that, the dataset also show an important takeaway: 11.11 continues to draw more visitors to e-commerce platforms as we can see that both platform visitor are growing where normally one will be dropping in compensate for the other, hence making it a critical period for customer acquisition.

Looking Ahead

With just one more month until the year’s end, let’s strive to hit our target goals and close the year on a high note. Here’s wishing everyone continued success in the e-commerce journey. See you next month!

This report is powered by robust data analytics from two industry leaders: Mobduos for Shopee and Kalodata for TikTok. But before we dive into the exciting findings, a word of caution: while our data provides valuable insights, always remember that there may be slight variations from real-time statistics. Get a free trial to Shopee and Tiktok Bigdata and let us know if you would like a promo code to purchase when you find them essential .