As we kick off this month’s discussion, I want to start by apologizing for the absence of last month’s report. We’ve been carefully analyzing the recent data gathered by Mobduos. Last month, the report of Shopee was at a staggering RM3.6 billion in sales, surpassing the peak of 2022 e-commerce figures, which feels somewhat hard to believe hence we decide to wait another month to decide, however for september the data was off too, hence like always, i would recommend to see the data as a trend mover and not focusing too much on the actual figure.

In September, TikTok held its seller summit and launched a new cashback program, they are offering a free 10-day trial period followed by a 50% promotional fee to test run the scheme. It seems likely that they might integrate this into the commission structure, similar to Shopee and Lazada once it stabilizes.

Shopee is also enhancing its return and refund mechanism, allowing buyers to apply for return/refund at any point of time, hence for seller that use drop off point need to ensure that their parcel is scan before leaving as if buyer request refund before the parcel is scanned, the parcel will be deem not processed and remain at the drop off point.

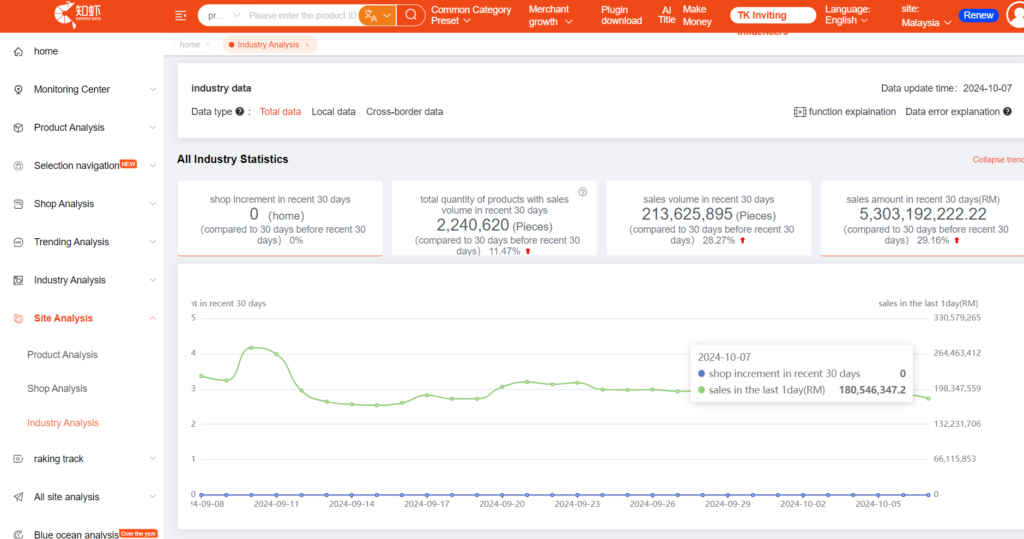

Shopee’s Data Insights

While Shopee’s system reports data at RM5.3 billion, I find myself questioning this figure, especially since TikTok doesn’t appear to be experiencing a comparable growth rate.

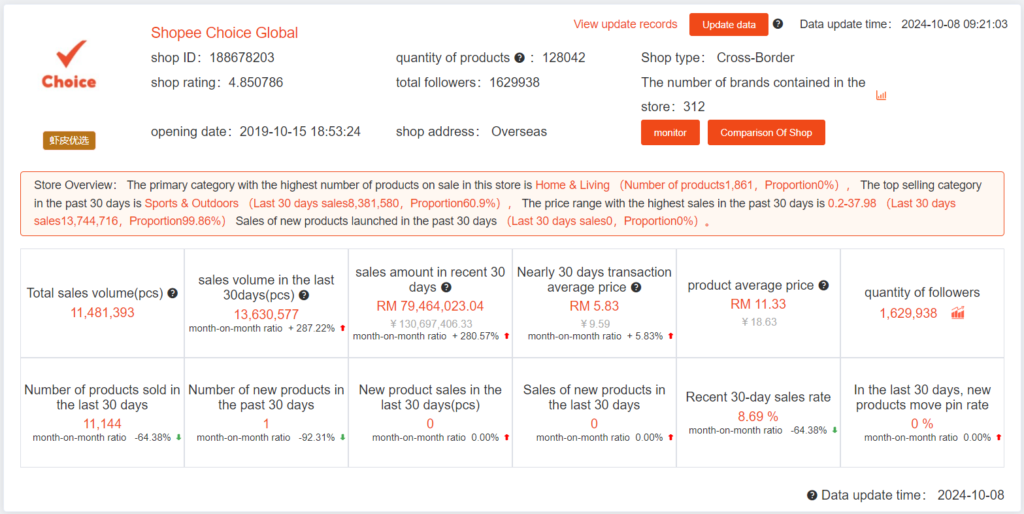

Shopee Choice Global Data: We observed a sharp increase to RM79 million which is also doubtful, hence please look at it as a guide. There have also some complaints regarding practices where they reportedly take reviews from sellers of similar products hence they might have double dipping sales figure, which also make sense if we take the total data and divide by half, however this are all base on assumption.

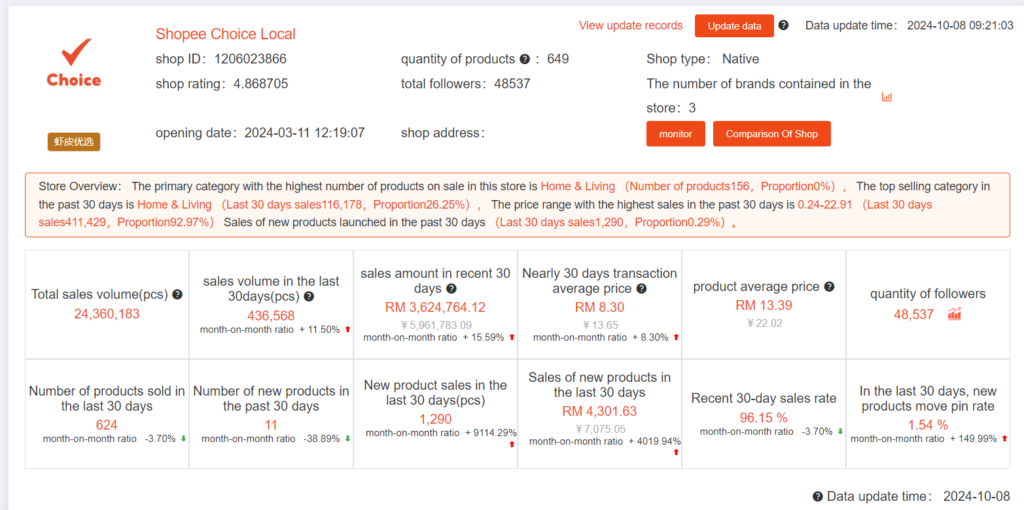

Shopee Choice Local Data: The local data appears more realistic at RM3.6 million, showing signs of growth. They recently also launched Shopee Consignment, allowing sellers to participate with minimal risk, however this approach could be a double-edged sword if not executed carefully.

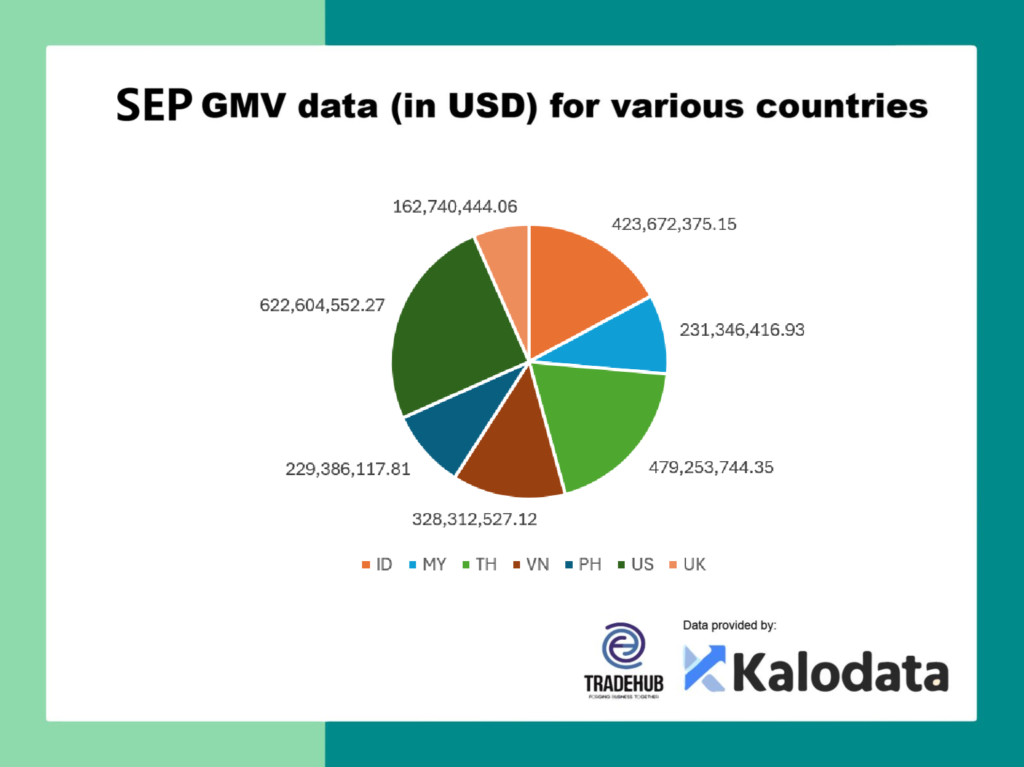

TikTok’s Monthly Sales

TikTok has experienced notable growth over the past two months, reaching RM975 million. With the introduction of cashback incentives, they may very well hit RM1 billion this month, especially with the Double 11 shopping event just around the corner.

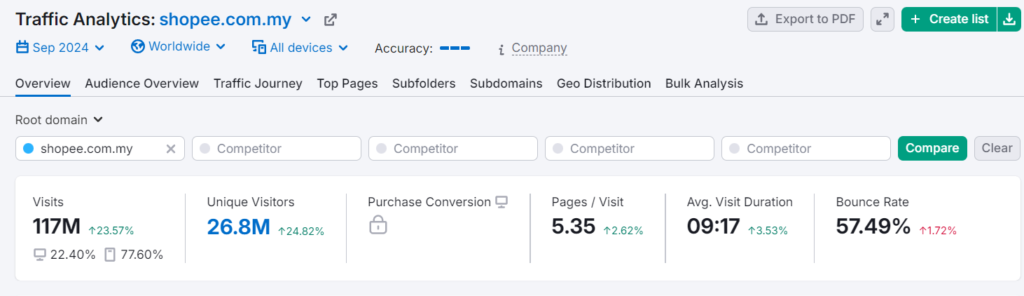

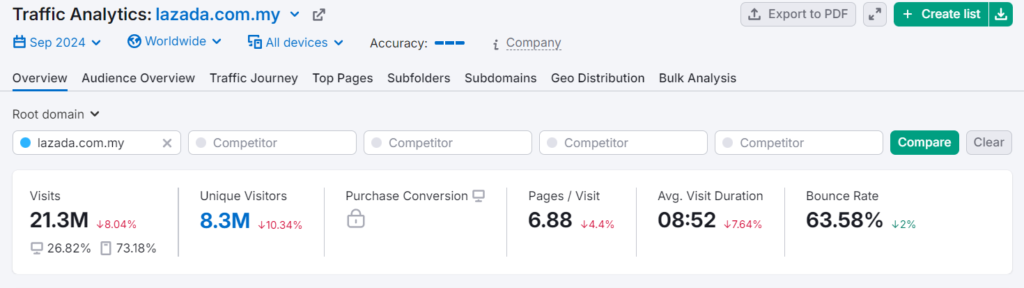

Let’s take a moment to analyze their website traffic. The increasing traffic on both platforms suggests a potential rise in GMV, likely driven by greater internet accessibility and increased online activity during the holiday season. Notably, Shopee traffic grew by alot prompting higher sales in the next few month?

That wraps up this month’s update. As we approach the end of the winter commerce season, I wish everyone smooth sailing as we head into year-end sales!

This report is powered by robust data analytics from two industry leaders: Mobduos for Shopee and Kalodata for TikTok. But before we dive into the exciting findings, a word of caution: while our data provides valuable insights, always remember that there may be slight variations from real-time statistics. Get a free trial to Shopee and Tiktok Bigdata and let us know if you would like a promo code to purchase when you find them essential .