As we move into April, many ecommerce sellers are noticing a familiar trend: sales are slowing, and competition is heating up. As a moderator of several seller communities, I’m seeing more and more discussions about declining traffic and increased challenges. While it’s easy to feel discouraged, understanding the bigger picture—and knowing how to adapt—can make all the difference.

The Seasonal Shift: What’s Happening?

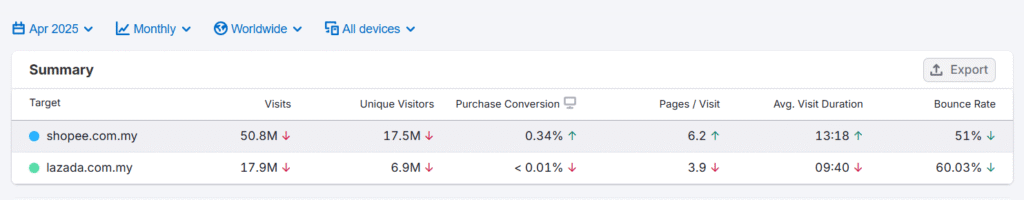

It’s no secret that ecommerce experiences seasonal fluctuations. This year, the “winter” phase has arrived a bit earlier than usual, largely due to the earlier Raya season. Across major platforms like Shopee and Lazada, traffic has dropped by at least 15%. This means fewer potential customers are browsing, and every sale is more competitive.

Revisiting the Sales Formula

In times like these, it’s helpful to return to the basics:

Sales = Traffic x Conversion Rate x Average Order Value (AOV)

If your store’s traffic is down, you still have two powerful levers to pull:

- Improve your conversion rate: Optimize your product listings, enhance your customer service, and streamline the checkout process.

- Increase your average order value: Introduce bundle deals, upsell complementary products, or offer incentives for larger purchases.

Alternatively, consider exploring new product segments or niches that may be attracting more attention during this period.

Platform Insights

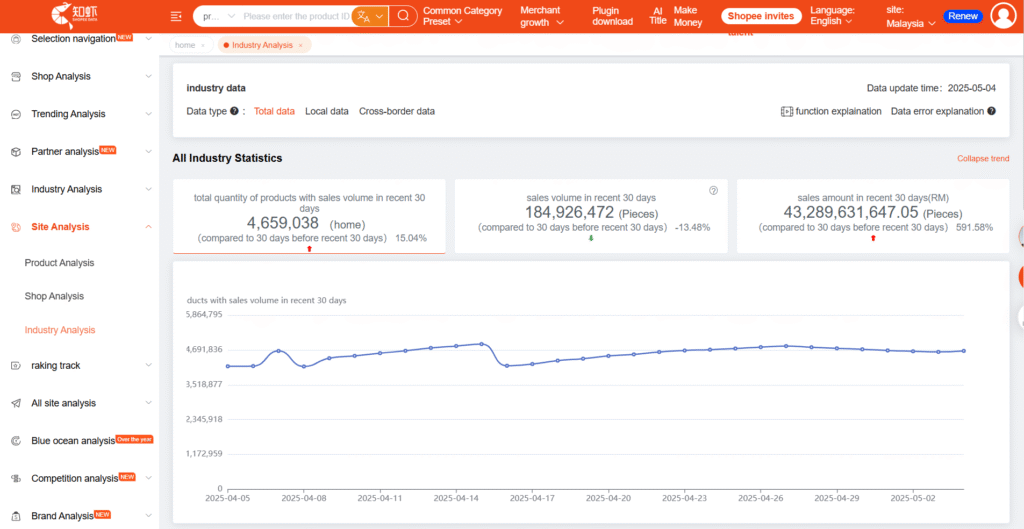

Shopee: Adjusting to the New Normal

Shopee sellers are facing higher fees and lower sales volumes, a combination that’s understandably frustrating. The platform is pushing its SpayLater program, which adds a 1% fee to sellers but also introduces more vouchers and incentives to encourage buyer spending. While this may not offset the challenges entirely, it’s an attempt to stimulate demand during a slow season.

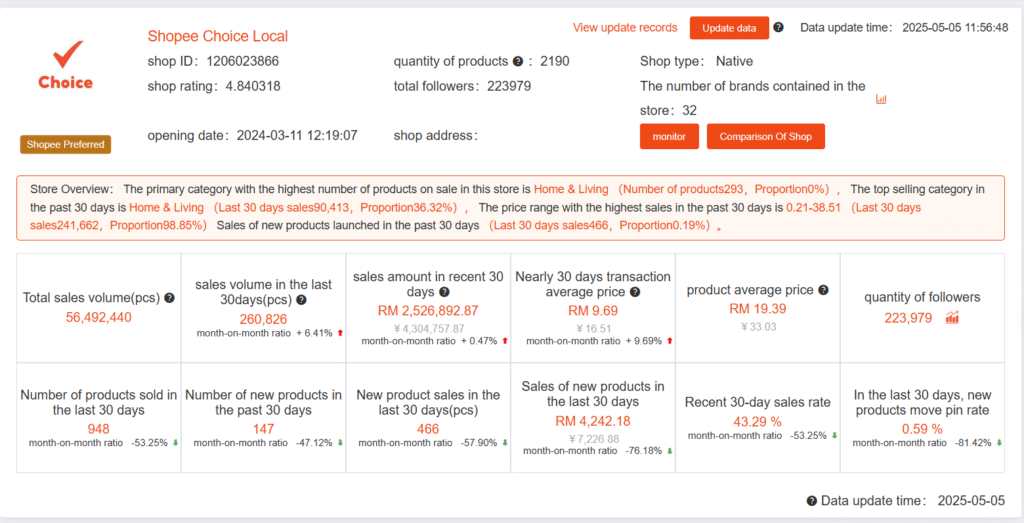

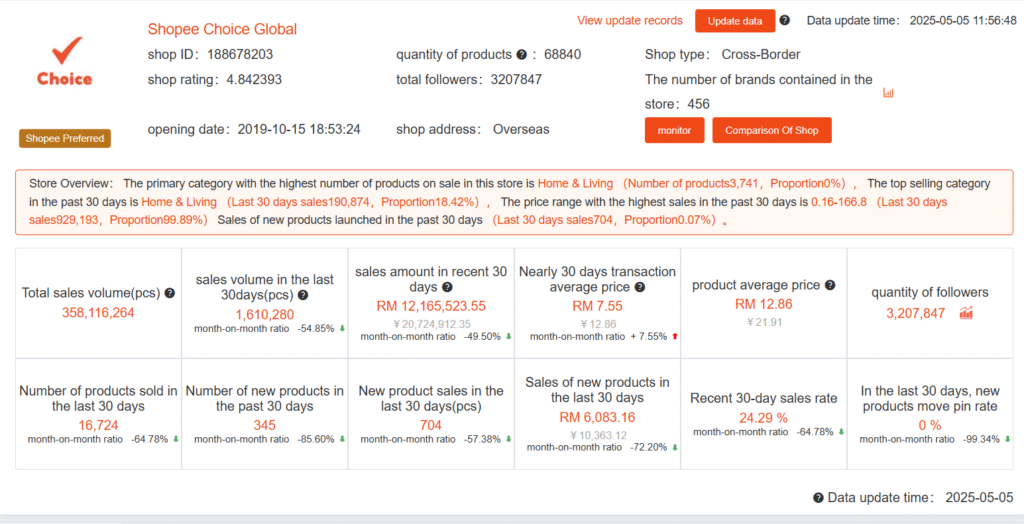

Shopee Choice: Plateauing Interest

Shopee Choice, once a driver of low-price, high-volume sales, appears to have lost some of its appeal. Many buyers are now more discerning, especially regarding product quality. Shopee Choice Local continues to perform relatively well, likely due to greater trust in local products.

TikTok Shop: Holding Steady

After an unexpected spike last month—possibly due to sellers manipulating sales for exposure—TikTok Shop’s numbers have stabilized. Despite expectations of a post-Raya dip, Malaysia’s TikTok sales remain above RM1 billion. This resilience is noteworthy and worth monitoring in the months ahead.

Lazada: Loyal Customers Remain

Lazada has experienced the steepest traffic decline among the major platforms. However, the drop in unique visitors is less severe, suggesting that while casual browsers may be leaving, loyal customers are still returning. This highlights the value of building and maintaining a strong customer base.

Looking Ahead

The current slowdown is expected to persist until mid-May, when the Haji season may provide a brief boost. August typically marks the lowest point of the year, but historically, sales rebound sharply in September as we approach the year-end peak.

Final Thoughts

Seasonal slowdowns are challenging, but they also present opportunities for sellers willing to adapt. Focus on optimizing your conversion rate and average order value, explore new segments, and stay engaged with your customer base. Most importantly, remember that these cycles are temporary—and those who innovate now will be best positioned for growth when the market rebounds.

Wishing everyone a productive and resilient ecommerce season. Let’s navigate this winter together and prepare for the next wave of growth.

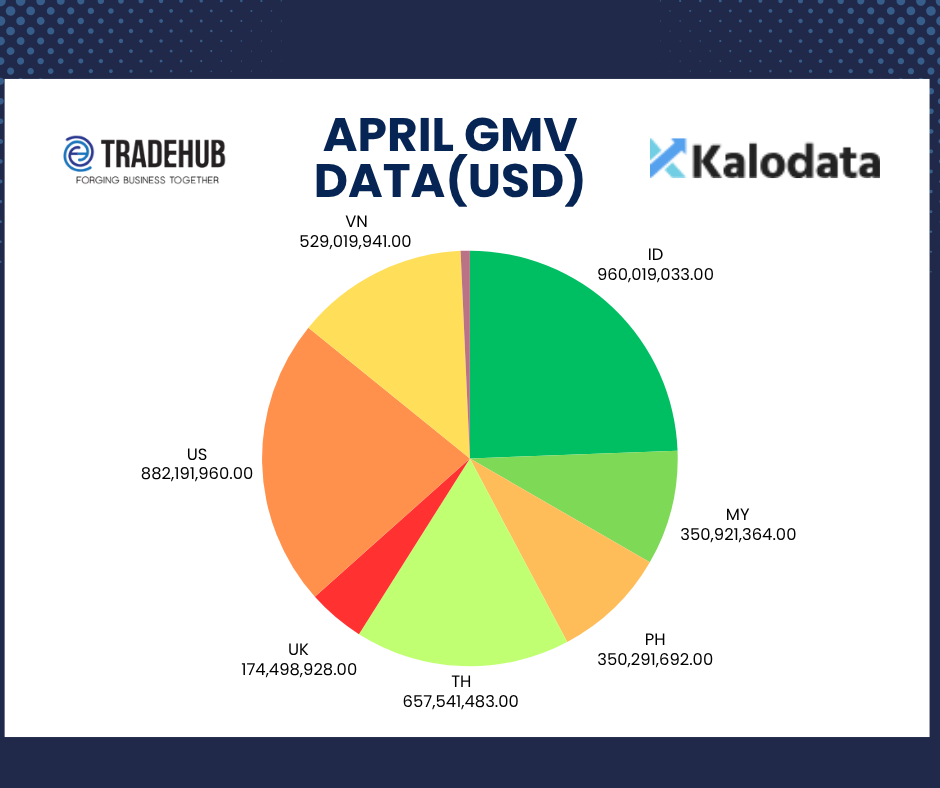

This report is powered by robust data analytics from two industry leaders: Mobduos for Shopee and Kalodata for TikTok. But before we dive into the exciting findings, a word of caution: while our data provides valuable insights, always remember that there may be slight variations from real-time statistics. Get a free trial to Shopee and Tiktok Bigdata and let us know if you would like a promo code to purchase when you find them essential .