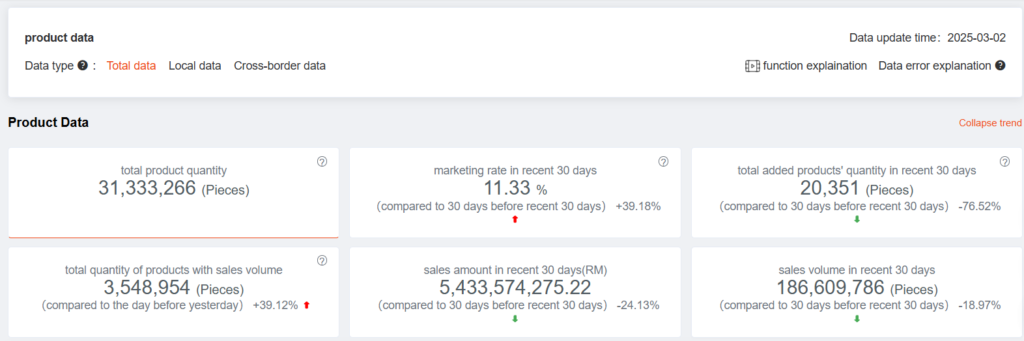

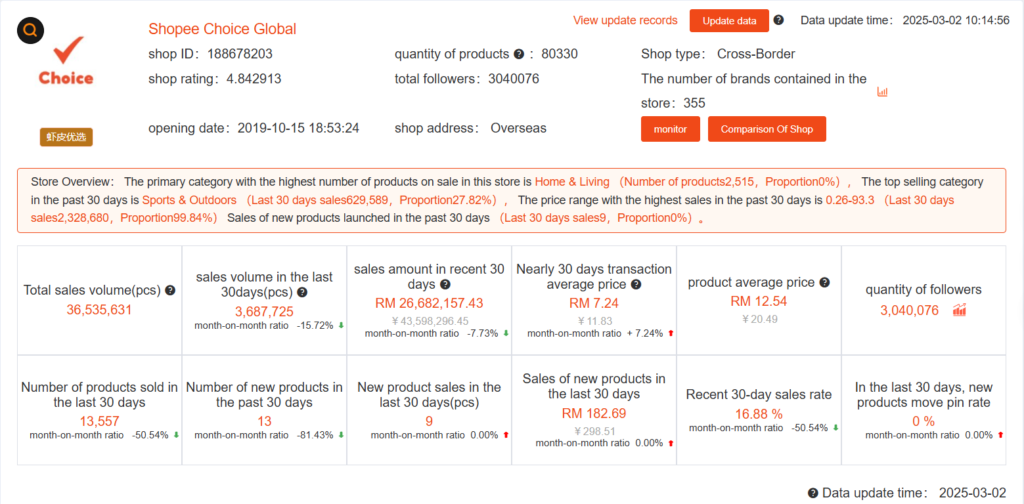

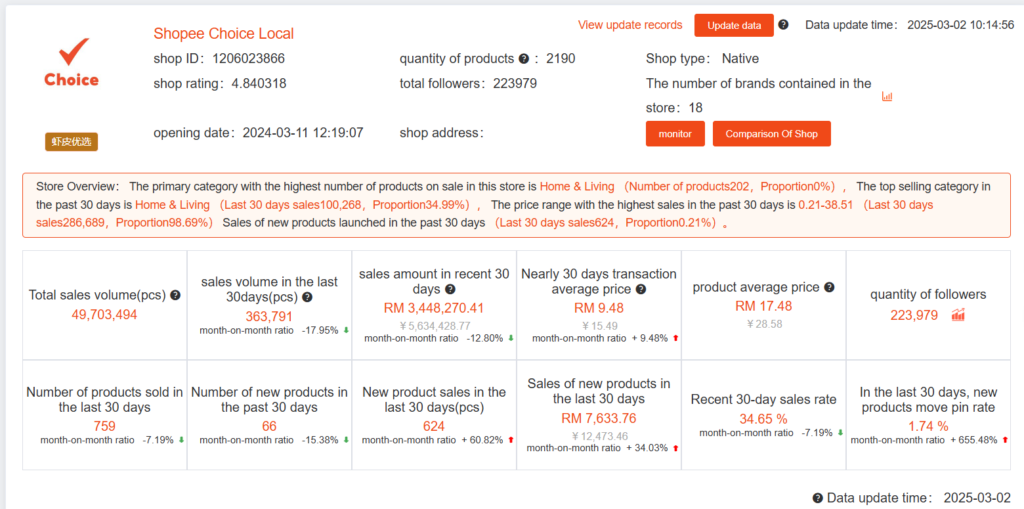

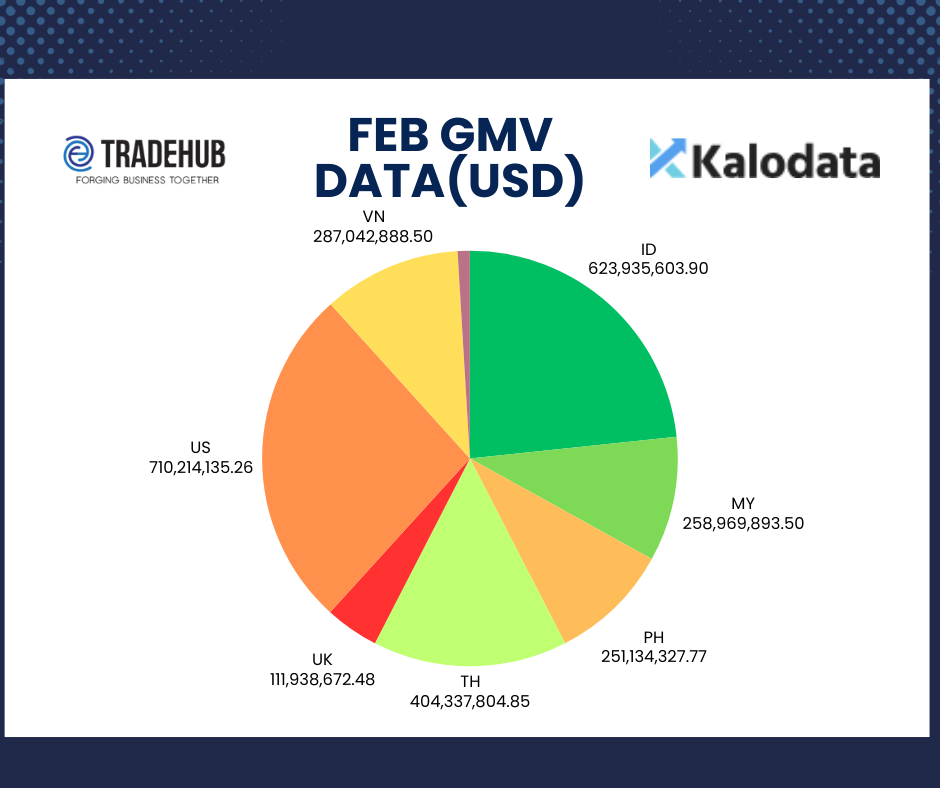

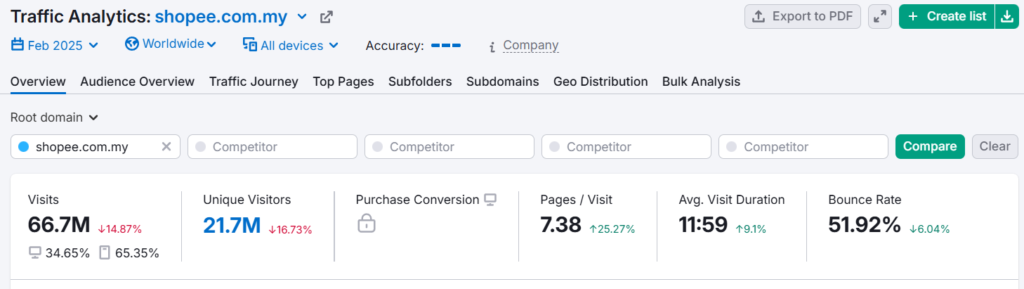

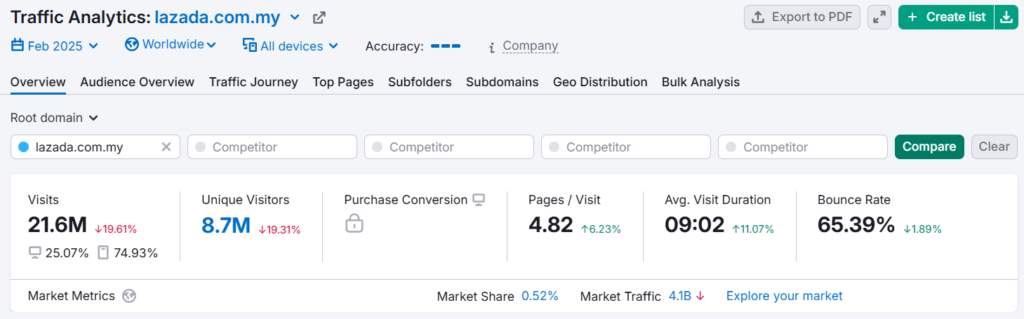

February proved to be a challenging month for e-commerce marketplaces in Malaysia and Singapore, with traffic declining by at least 10% across major platforms. Shopee, the region’s leading player, reported a notable drop in sales, closing at RM54 billion compared to RM62 billion the previous month—a clear reflection of the impact of reduced traffic on the Sales Golden Formula (Traffic x Conversion x Average Order Value).

For the first time in 2025, even Shopee’s Choice Local and Global segments saw a decline, underscoring the broader slowdown.

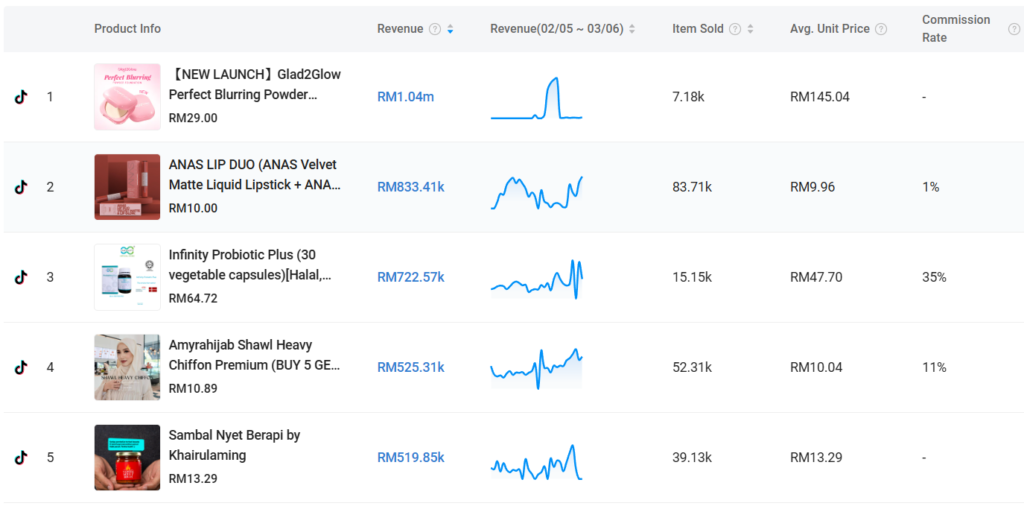

Meanwhile, TikTok Shop bucked the trend, posting gains as marketplaces eased off their promotional efforts. The platform capitalized on this gap by ramping up vouchers and targeted campaigns, driving sales at a time when others faltered. This divergence highlights TikTok’s ability to seize opportunities during quieter periods.

Why the Slowdown?

The dip in website traffic likely stems from a post-Chinese New Year lull, with consumers holding off on purchases ahead of Hari Raya Aidilfitri, expected in end-March 2025. Shoppers appear to be in a holding pattern, delaying spending until festive demand picks up—a pattern consistent with seasonal trends in the region.

Top-Performing Categories: What’s Selling Best?

TikTok Shop’s growth this month was driven by a surge in demand for Muslim-related products, such as apparel, accessories, and festive goods, aligning with the approaching Raya season. This month we saw muslimah product come into top 5 focus positions.

Opportunities for Sellers

For e-commerce businesses looking to capitalize on current trends, TikTok Shop offers a strategic entry point. Products tied to Raya preparations are gaining traction, and the platform’s promotional push could yield strong returns in the short term. While Shopee remains the dominant force, its February performance signals that agility across platforms is key during off-peak months.

Looking Ahead

As March unfolds, expect traffic to rebound as Raya nears, revitalizing platforms like Shopee and Lazada. TikTok’s current momentum, however, suggests it will remain a formidable contender in the pre-festive buildup. Stay tuned for updates as we track the latest data and market shifts.

This report is powered by robust data analytics from two industry leaders: Mobduos for Shopee and Kalodata for TikTok. But before we dive into the exciting findings, a word of caution: while our data provides valuable insights, always remember that there may be slight variations from real-time statistics. Get a free trial to Shopee and Tiktok Bigdata and let us know if you would like a promo code to purchase when you find them essential .