Navigating Regulatory Changes: Indonesia’s Move to Separate Social Media and E-commerce

In a significant regulatory development, the Indonesian government has implemented measures to separate social media and e-commerce platforms. This decision, driven by concerns over data privacy and its potential misuse, has far-reaching implications for the e-commerce landscape in the region. Let’s dive into the details and consider its implications.

The Regulatory Shift

Effective as of September 25, 2023, Indonesia announced that social media platforms would no longer be permitted to serve as e-commerce hubs. This move is part of the government’s strategy to safeguard user data and prevent any potential misuse. While this decision has its merits in protecting consumer information, it marks a pivotal moment for the industry.

Indonesia’s E-commerce Impact

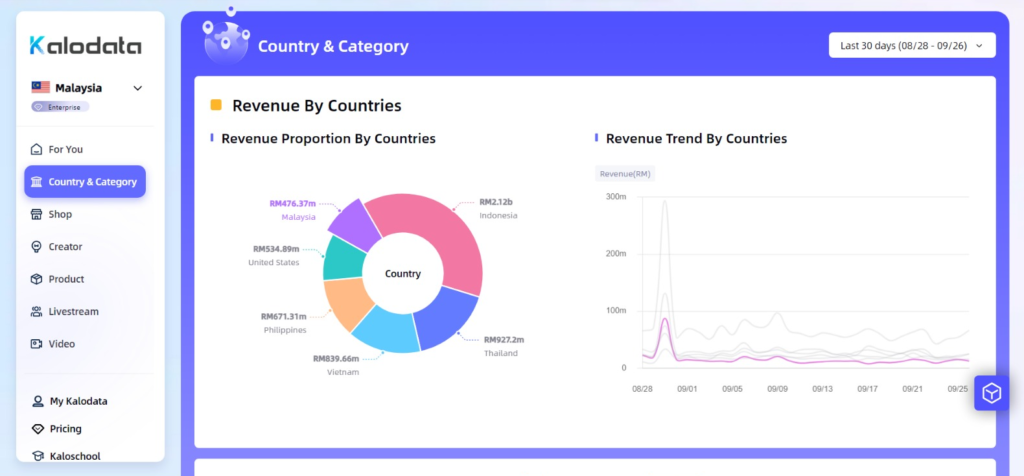

Prior to this regulatory shift, Indonesia had been Tiktok Main core country in Southeast Asia (SEA) in terms of e-commerce revenue. The nation commanded a substantial share of SEA’s e-commerce pie, raking in an impressive RM2.12 billion. However, signs of a slowdown had already begun to surface, particularly in Malaysia, where TikTok Shop’s sales dropped significantly from a peak of RM730 million to below RM500 million.

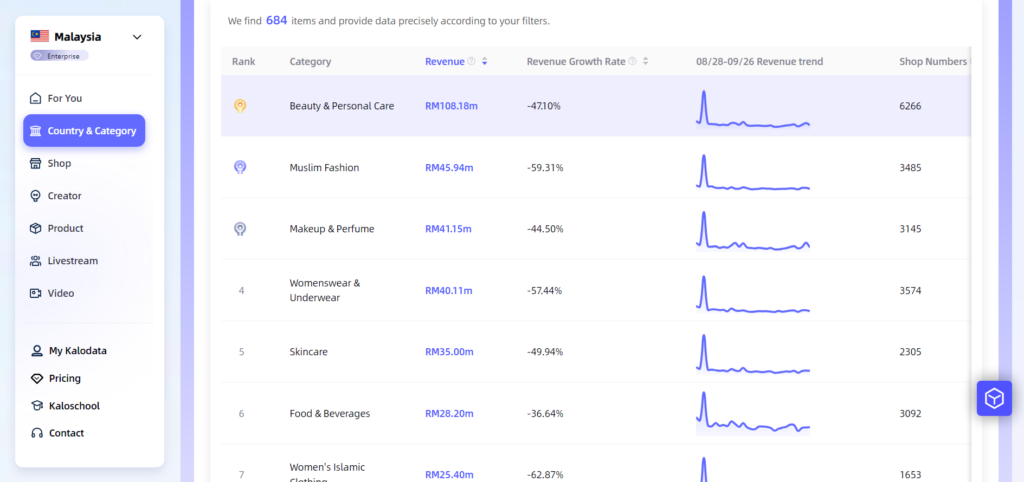

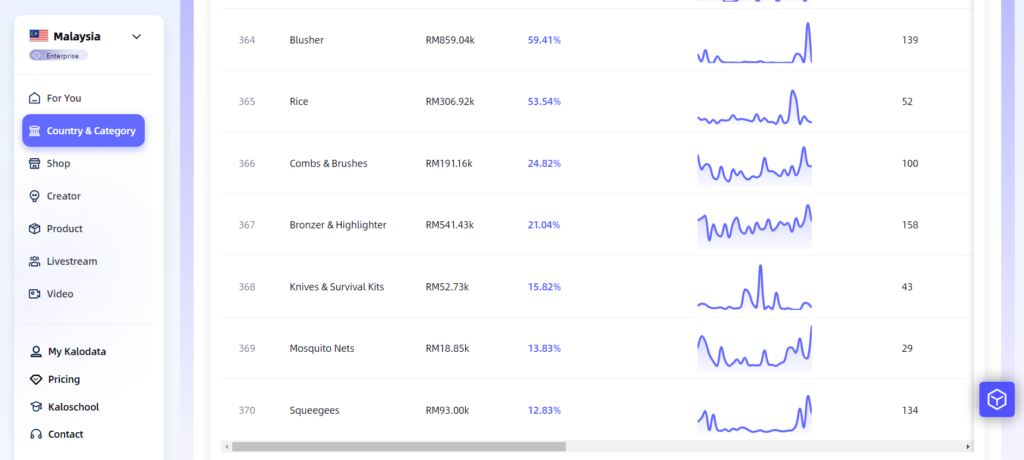

Almost all major product categories within TikTok Shop experienced a substantial dip of more than 40%. The exceptions to this trend were the hair and facial care categories, as well as rice, driven by the rising cost of rice imports in Malaysia.

These insights are courtesy of Kalodata, a TikTok big data analysis tool, which aids users in identifying potential affiliate opportunities and predicting emerging product trends. To embark on a 7-day journey of discovery, register here. Get a 10% off by using Tradehub as your referral code.

The Future of E-commerce in Indonesia

In response to these regulatory changes, TikTok may explore the possibility of creating a stand-alone e-commerce platform to comply with the government’s regulations. However, if such endeavors are also prohibited, it is likely that other major players in the Indonesian e-commerce sector, such as Shopee, Bukalapak, and Tokopedia, will step in to fill the void.

Potential Impact on Malaysia

If Indonesia indeed closes its doors to e-commerce on social media platforms, there could be a notable shift in investment focus towards neighboring countries like Vietnam, the Philippines, and Malaysia. A comparison of TikTok’s market share with Shopee in these regions reveals interesting market dynamics:

| Tiktok | Shopee | ||

| Malaysia | RM468M | RM1.4B | 33% |

| Indonesia | RM2.1B | RM5.1B | 41% |

| Thailand | RM930M | RM2.3B | 40% |

| Vietnam | RM831M | RM2.6B | 32% |

| Philippine | RM667M | RM2.1B | 32% |

Investment Considerations

Given these developments, one question arises: Should businesses consider investing more in TikTok in this uncertainty time? While TikTok remains a strong social media platform, it is prudent to approach such decisions with caution. The situation in Malaysia may evolve in unforeseen ways, and diversifying your online presence remains a smart strategy to mitigate risks. Relying solely on one platform, whether TikTok or another, carries inherent uncertainties.

In conclusion, these regulatory changes in Indonesia emphasize the importance of staying informed about evolving policies and diversifying your online marketing strategies. By assessing platforms based on performance, user demographics, and alignment with your business objectives, you can make informed decisions in an ever-evolving digital landscape.

Stay informed, stay ahead.

#ShopeeVsTikTok #EcommerceEra