Hi everyone! Welcome to the cover story for Malaysia’s October E-Commerce Insights. While last month’s data felt a bit off, as always, I recommend treating the numbers as trend indicators rather than focusing too much on exact figures.

Let’s dive into the highlights for October:

Shopee’s Stricter Penalty Points System

In October, Shopee raised the stakes with their penalty system. Certain violations—like counterfeit or spam listings—now carry 6 penalty points, up from 2 previously.

What’s the impact of 6 penalty points?

- Sellers are immediately pushed into Penalty Tier 2.

- Consequences include:

- Removal of shipping rebates, making free shipping offers impossible.

- Moderate product deboost, meaning fewer buyers will see your listings.

This change is significant as buyers often prioritize free shipping when making purchases. So please sellers, take note! Avoid common pitfalls like spam listings to protect your store’s visibility and profitability.

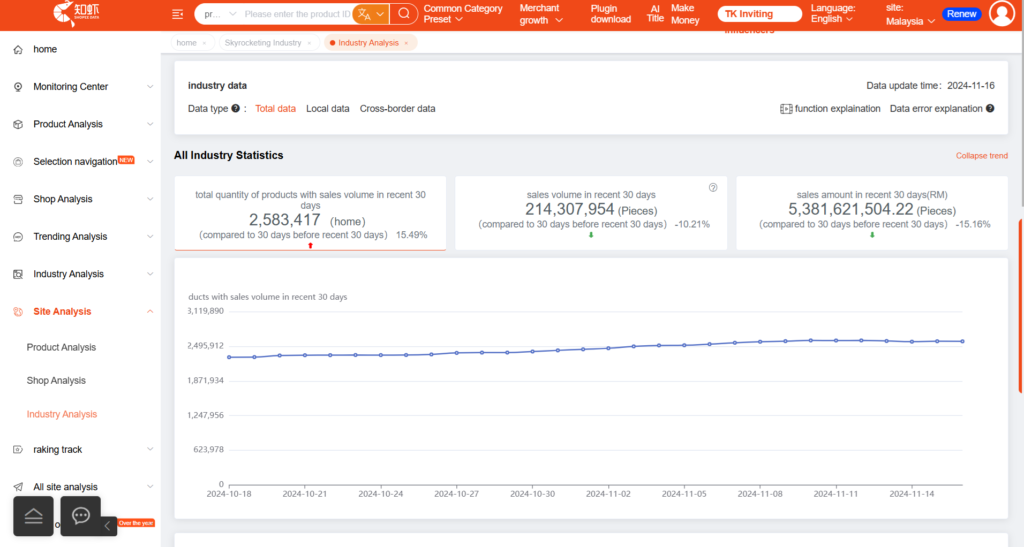

Shopee’s Performance in October

October was a quiet month for Shopee, with minimal growth observed. While i anticipated a drop due to the drop in visitor, late data updates make it hard to gauge exact performance of it.

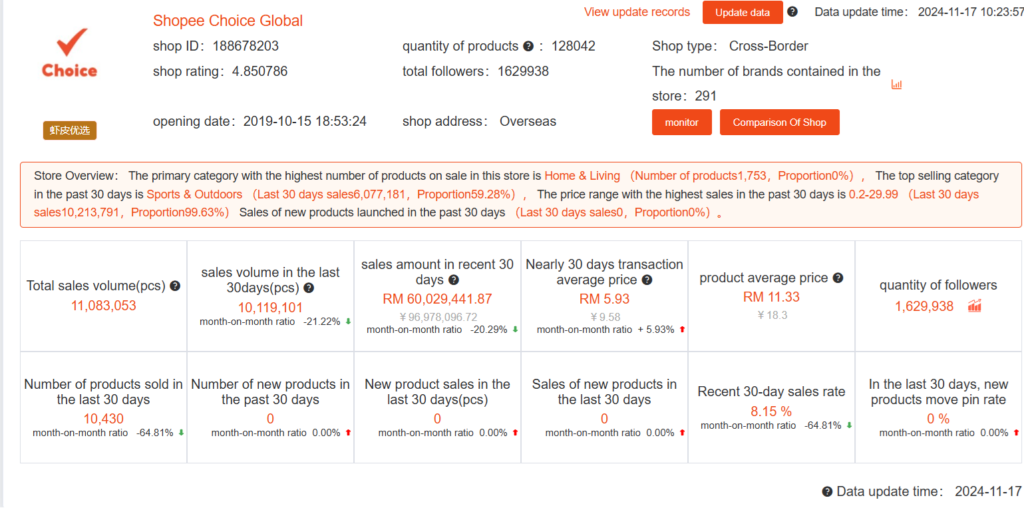

Shopee Choice Global Data:

Sales under Shopee Choice Global saw a sharp decline, dropping to RM60 million. This was likely due to Lazada’s strong offline marketing push in October, which captured a larger share of the market.

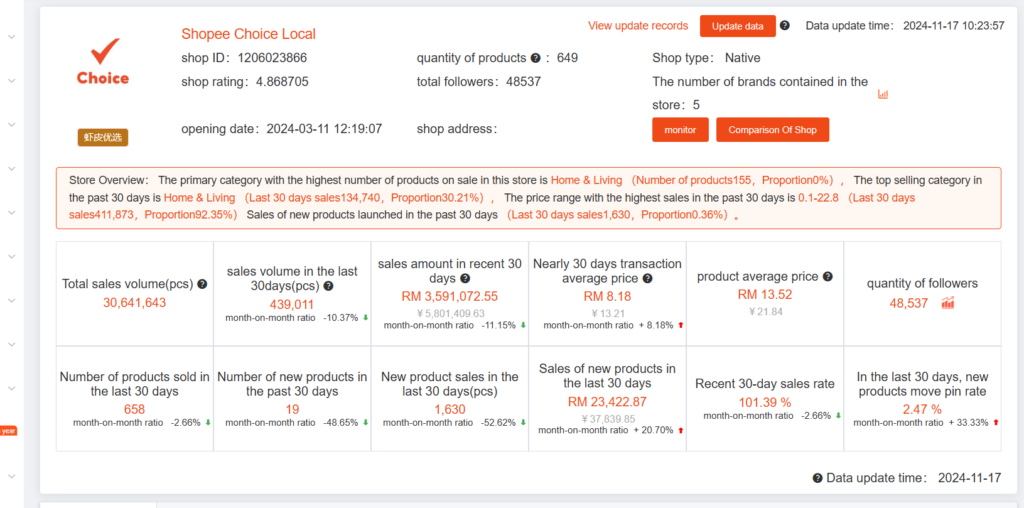

Shopee Choice Local Data: Shopee Choice Local data held steady at RM3.59 million. While Shopee recently launched its consignment service, its impact hasn’t shown up in the data yet. Perhaps we’ll see growth in the coming months.

TikTok’s E-Commerce Momentum

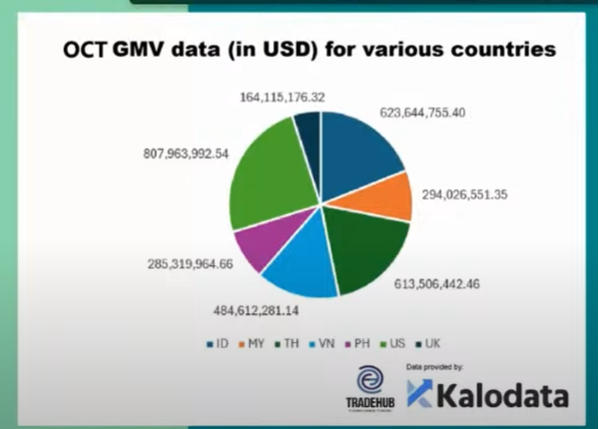

TikTok played it smart in October, focusing heavily on this month after letting competitors dominate September. The result? RM1.2 billion in monthly sales, surpassing the billion-ringgit mark once again!

If TikTok keeps up this momentum, it might hit RM1.4 billion in November. Their strategy, leveraging vouchers and aggressive marketing, continues to pay off.

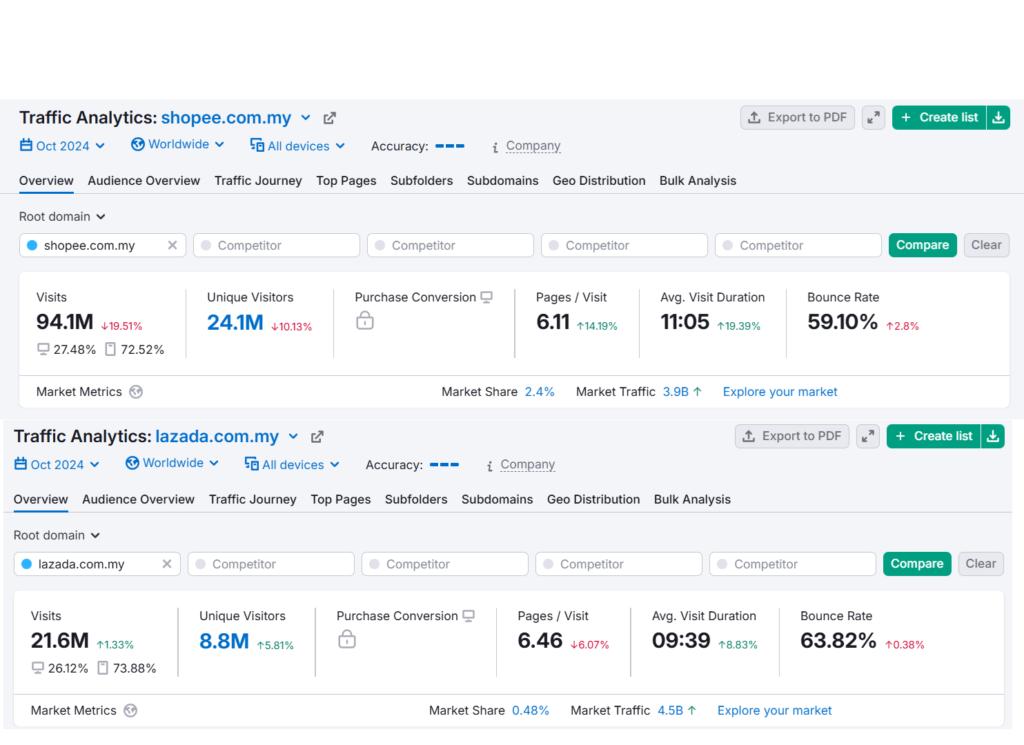

Website Traffic Trends

Marketing efforts significantly influenced website traffic this month. We can see that lazada visitor count is finally growing again because of this.

- Lazada:

Their offline roadshow events leading up to 11.11 boosted visitor growth rates, giving them a competitive edge. - Shopee:

Shopee’s visitor rate dropped by 10%, likely due to Lazada’s offline initiatives and TikTok’s aggressive voucher campaigns.

Takeaway: Platforms need strong, consistent marketing efforts—online and offline—to drive traffic and maintain market share.

Looking Ahead

That wraps up this month’s update! With November’s 11.11 sales in sight, I hope everyone is preparing for a strong finish to the year. Stay tuned for more insights in the coming month.

Key Takeaways for Sellers

- Avoid penalties by ensuring your listings comply with Shopee’s rules.

- Monitor marketing trends and competitors to stay ahead.

- Leverage platforms that align with your business goals—TikTok’s momentum is one to watch!

This report is powered by robust data analytics from two industry leaders: Mobduos for Shopee and Kalodata for TikTok. But before we dive into the exciting findings, a word of caution: while our data provides valuable insights, always remember that there may be slight variations from real-time statistics. Get a free trial to Shopee and Tiktok Bigdata and let us know if you would like a promo code to purchase when you find them essential .