Malaysia E-Commerce Scene: May 2025 Deep Dive

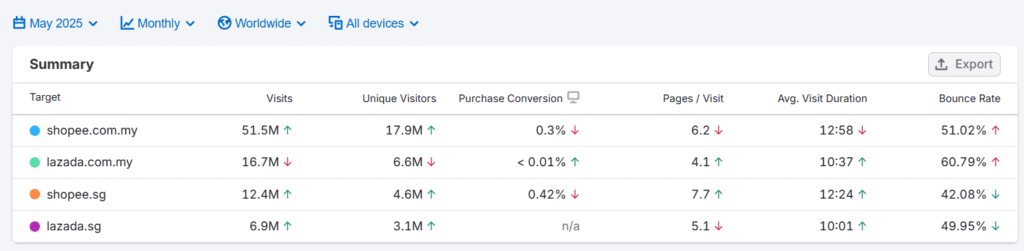

May 2025 has proven to be a pivotal month for Malaysia’s e-commerce landscape, marked by shifting consumer behaviors post-Raya, intensified platform competition, and evolving strategies from key players like Shopee, Lazada, and TikTok Shop.

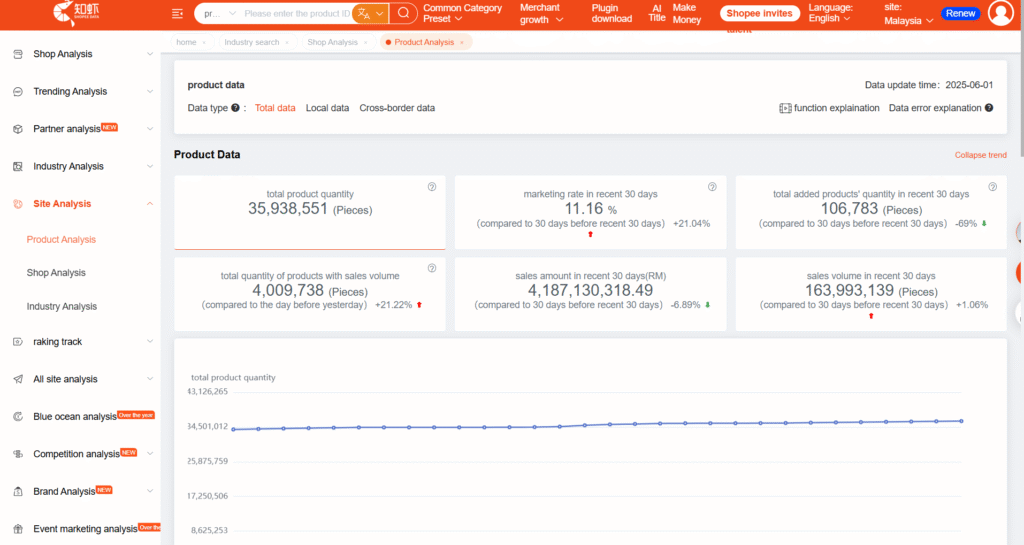

Shopee: Recovery and Strategic Adaptation

After a period of decline, Shopee’s Gross Merchandise Value (GMV) rebounded, signaling regained momentum. This recovery can be attributed to several tactical moves:

- Voucher Campaigns & SPayLater: Shopee ramped up voucher releases and promoted its buy-now-pay-later service, SPayLater, both of which have proven effective in re-engaging users and driving up platform traffic after a noticeable drop.

- Conversion Over Traffic: Despite only modest growth in visitor numbers, Shopee’s sales increased, highlighting the importance of conversion rate optimization. AI-powered personalization and interactive livestreams have successfully boosted impulse purchases and average order values.

- Logistics & Trust: Enhanced delivery options like Same Day and Next Day Delivery, along with a secure shopping ecosystem, have strengthened buyer confidence and encouraged early, budget-conscious shopping, especially around festive periods like Raya.

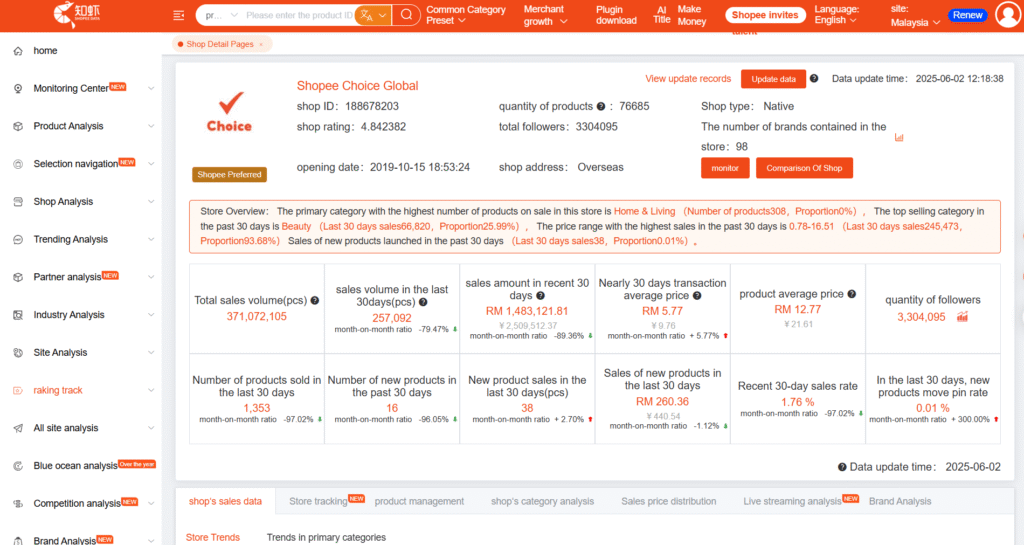

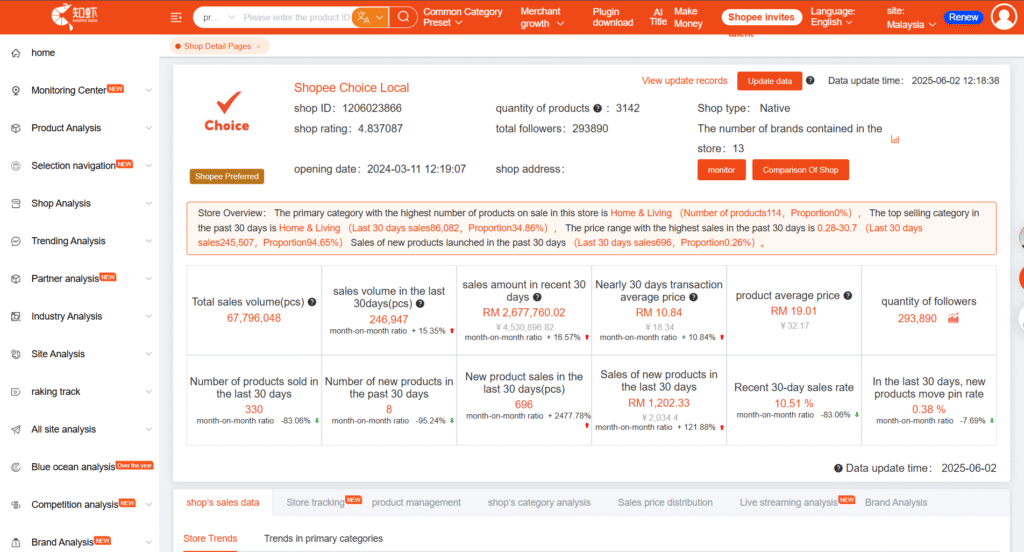

Shopee Choice: Global vs. Local Dynamics

A surprising trend has been the sharp decline in Shopee Choice Global. One plausible reason is the migration of China-based sellers to local setups, incentivized by higher cross-border fees imposed by Shopee. This shift allows sellers to reduce costs and offer more competitive pricing, which may explain the stagnation in Shopee Choice Local as well.

Lazada: Continued Challenges

Lazada’s position has weakened, with forecasts indicating a slight revenue decline through 2025. The platform’s inability to sustain traffic growth post-Raya, coupled with strong competition from Shopee and TikTok Shop, has resulted in a continued drop in engagement and sales.

TikTok Shop: Festive-Driven Surge

TikTok Shop experienced a remarkable resurgence in May, largely fueled by the return of Muslim shoppers post-Haji and the platform’s successful “Raikan Raya 2025” campaign. Key highlights include:

- 100% Year-on-Year Sales Growth: Driven by collaborations between over 1.7 million local sellers and 3 million affiliate creators, TikTok Shop doubled its sales compared to the previous year.

- Category Winners: Muslim fashion, beauty, and food products were top sellers, reflecting the platform’s resonance with festive and cultural needs.

- Engagement: The average number of orders per customer more than doubled during campaign periods, signaling strong consumer trust and platform stickiness.

Looking Ahead

As the dust settles after the festive rush, the focus shifts to whether Shopee can sustain its recovery, how TikTok Shop will maintain its growth post-campaign, and if Lazada can reverse its downward trend before the year-end sales. The market remains highly competitive, with platforms innovating rapidly to capture Malaysia’s increasingly savvy and mobile-first consumers.

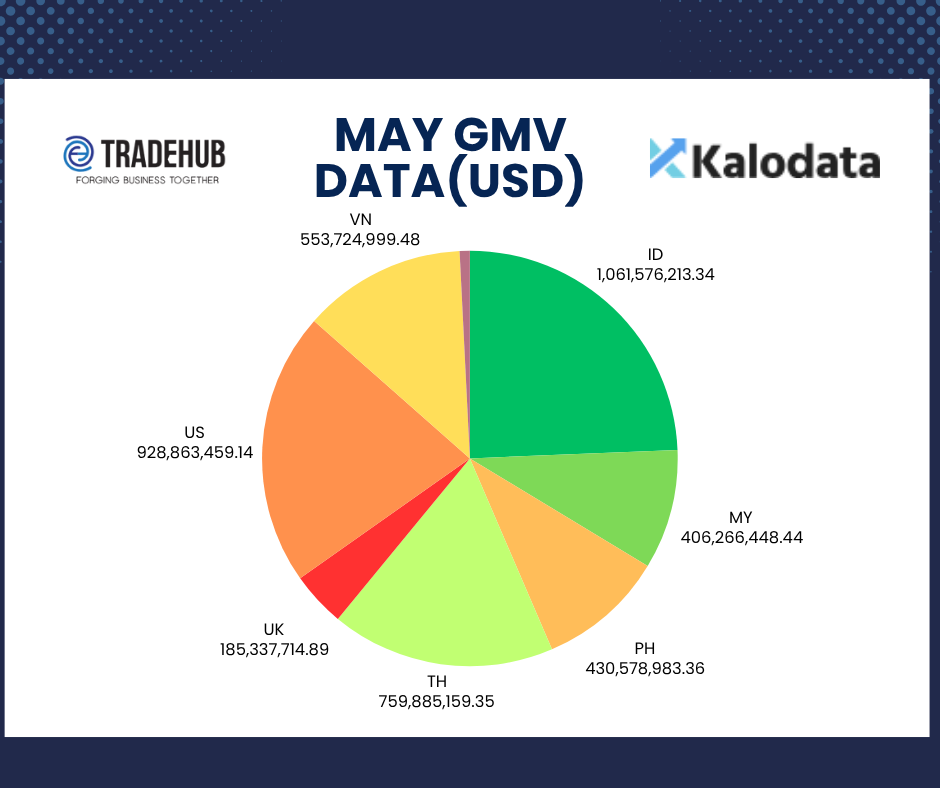

This report is powered by robust data analytics from three industry leaders: Mobduos for Shopee, Kalodata for TikTok and website traffic from SEMRush. But before we dive into the exciting findings, a word of caution: while our data provides valuable insights, always remember that there may be slight variations from real-time statistics. Get a free trial to Shopee and Tiktok Bigdata and let us know if you would like a promo code to purchase when you find them essential .